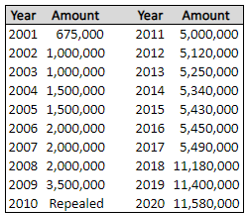

unified estate tax credit 2021

What Is the Unified Tax Credit Amount for 2021. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

End Of Year Tax Planning 2021 Albany Business Review

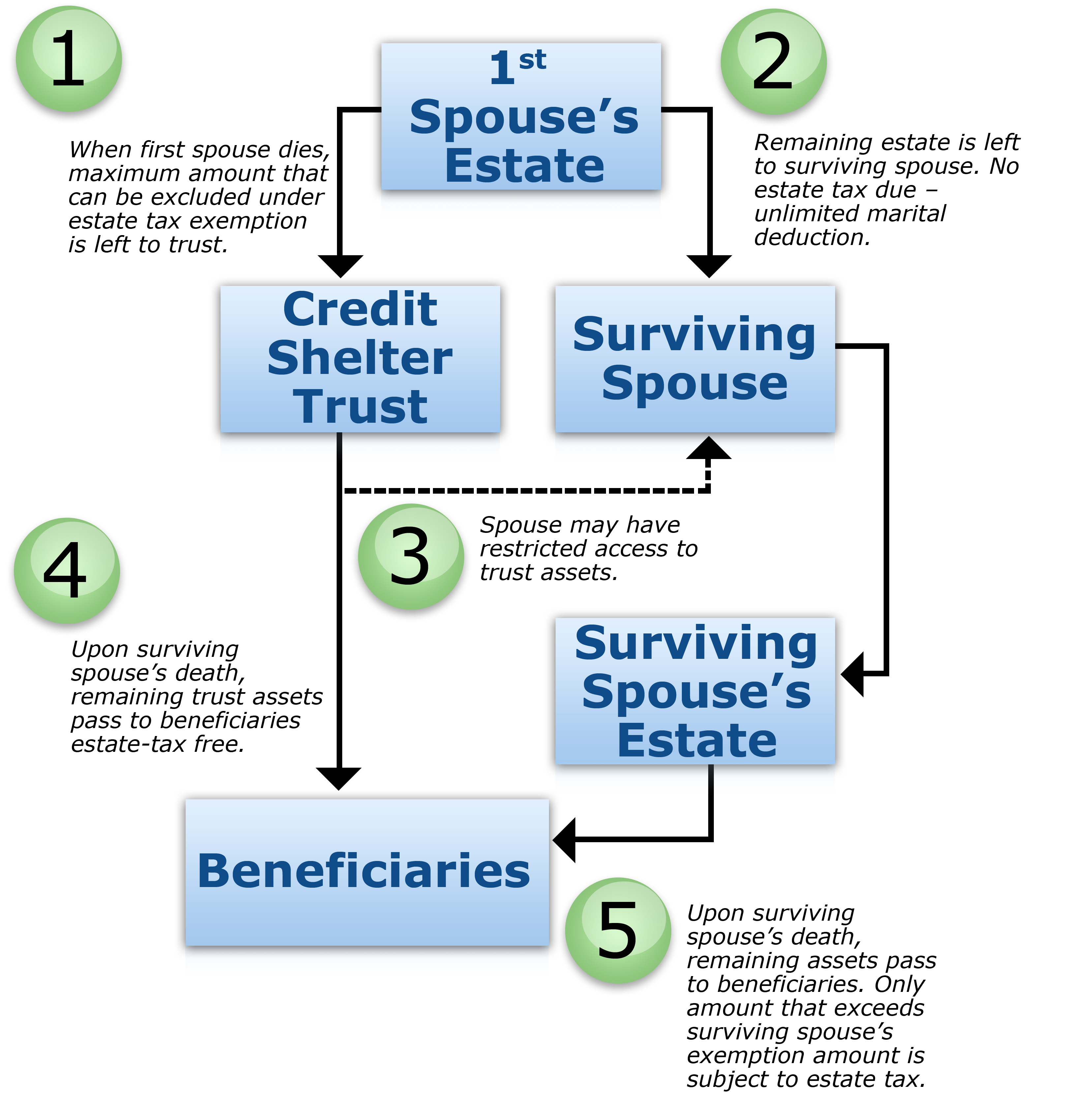

So individuals can pass 117 million to their heirsand couples can transfer twice that.

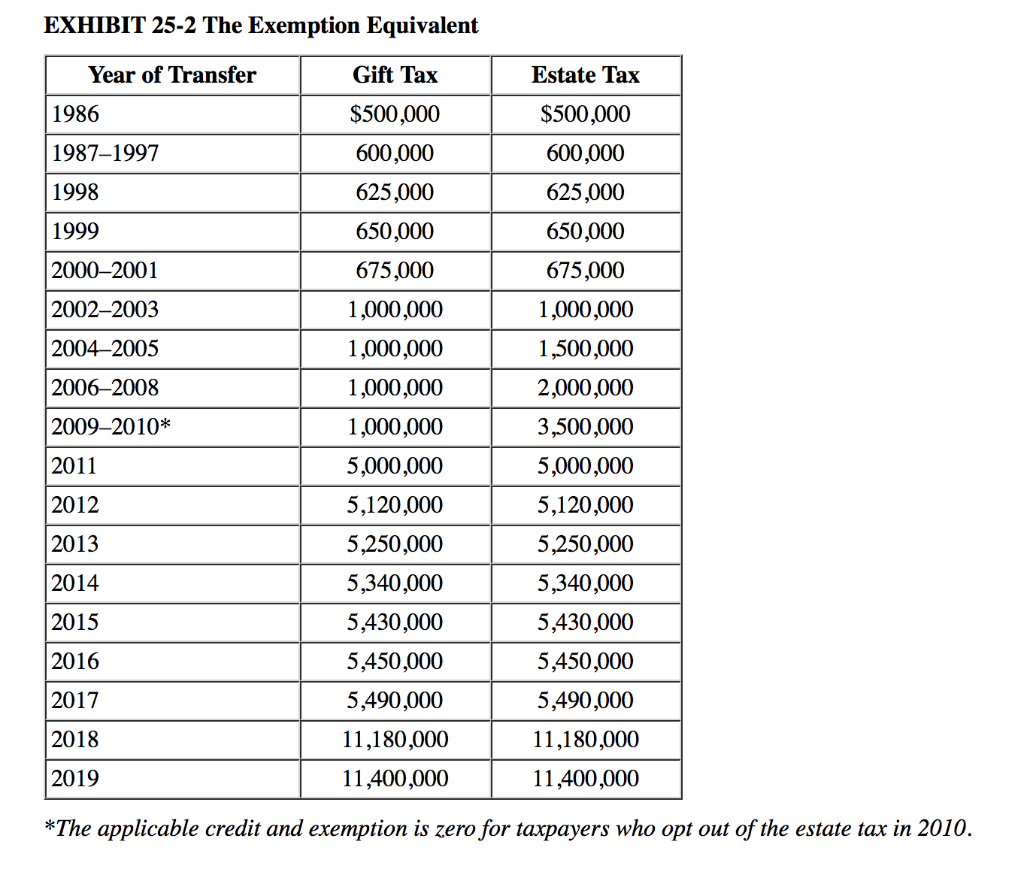

. The Internal Revenue Service announced today the official estate and gift tax limits for 2021. Unified Estate And Gift Tax. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

The basic credit amount for 2021 is 4625800. The previous limit for 2020 was 1158 million. Complete Edit or Print Tax Forms Instantly.

For 2022 the lifetime gift and estate exemptions increased to 1206 million per. Service Fees A charge for processing all creditdebit card transactions. The California Tax Credit Allocation Committee CTCAC facilitates the investment of private capital into the development of affordable rental housing for low-income Californians.

What Is Unified Credit for 2021. Or of course you can use the unified tax credit to do a little bit of both. Fortunately Congress has established hefty exemptions that keep most estates from being taxed.

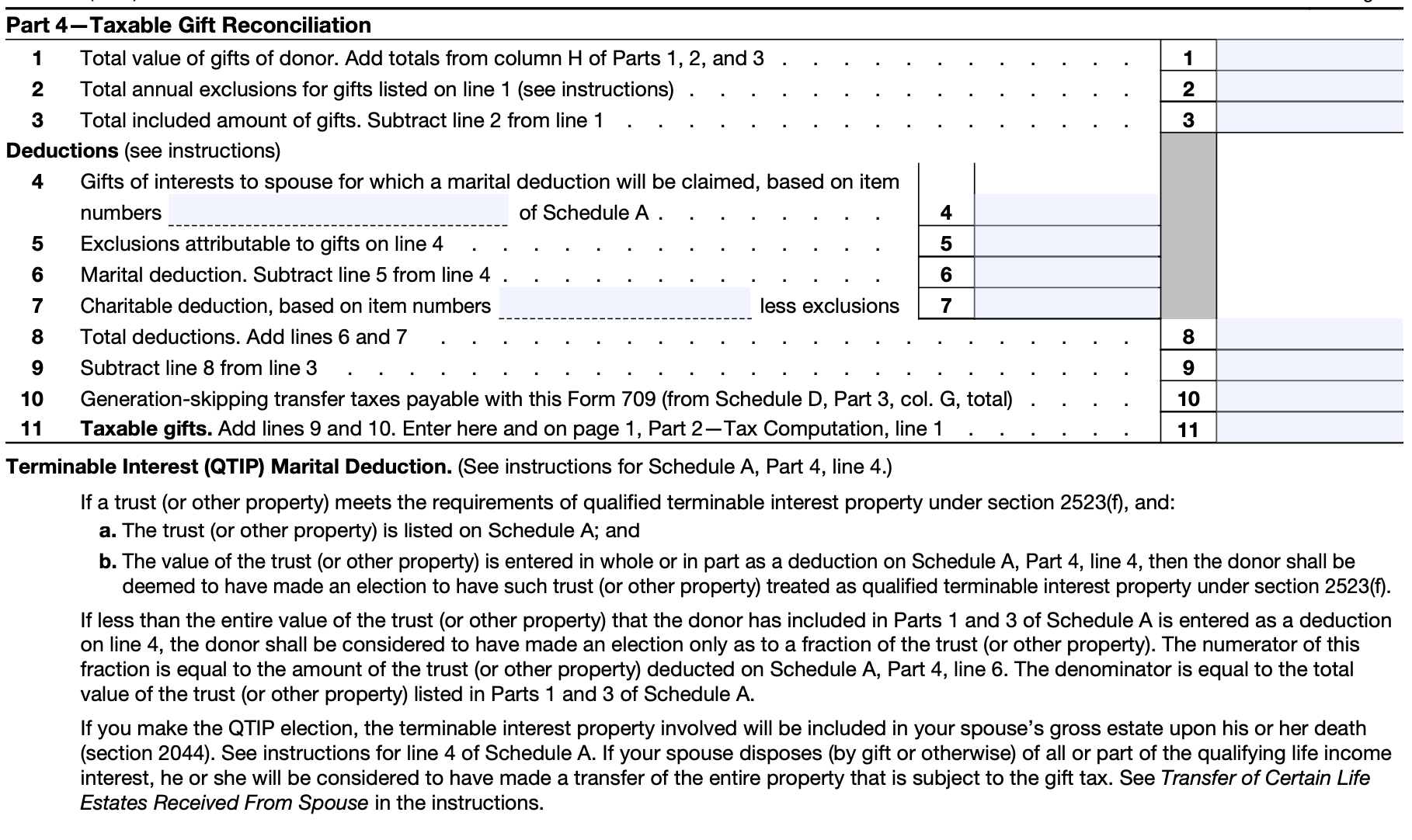

The unified aspect of this tax credit is that gift and estate taxes are rolled into one system to reduce your overall tax bill. The IRS announced new. See Table for Computing Gift Tax.

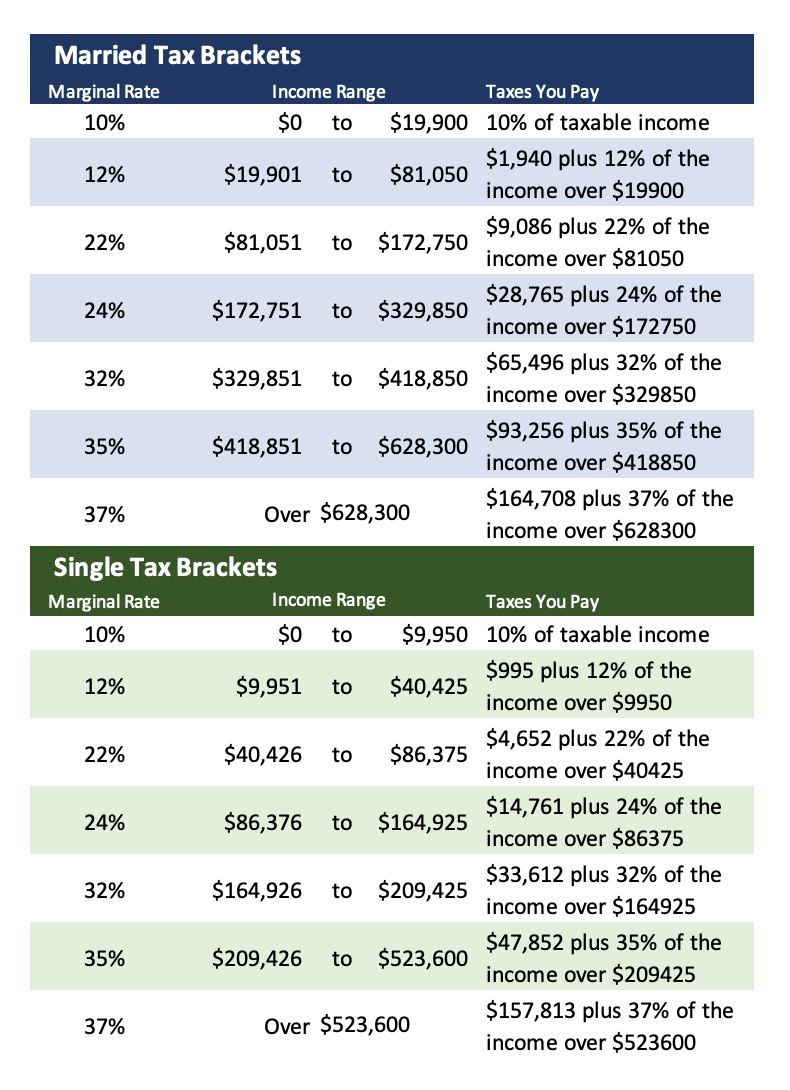

Secured Property Tax Information Request form A form to request information on multiple properties all at once. The Estate Tax is a tax on your right to transfer property at your death. Have income between 1 57414.

New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. You can find all available credits listed below including a brief description which forms and schedules. The 2021 federal tax law applies the estate tax to any amount above 117 million.

The previous limit for 2020 was 1158 million. Wondering what tax credits you can claim on your Indiana individual income tax return. What Is the Unified Tax Credit Amount for 2022.

Eligible households can receive up to 6728. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

To qualify you must. If a tax on a gift has been paid under chapter 12 sec. File a federal income tax return.

See Transfers Subject to an Estate Tax Inclusion Period ETIP earlier and section 2642f. To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the. The unified tax credit changes regularly depending on.

File with a Social Security Number.

History Of The Unified Tax Credit Apple Growth Partners

What Is The 2021 New York Estate Tax Exclusion Long Island Estate Planning

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Generation Skipping Transfer Taxes

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

2016 Federal Estate Tax Exemption Amount Wills Trusts And Estates

A Guide To Estate Taxes Mass Gov

Irs 2021 Tax Tables Deductions Exemptions Purposeful Finance

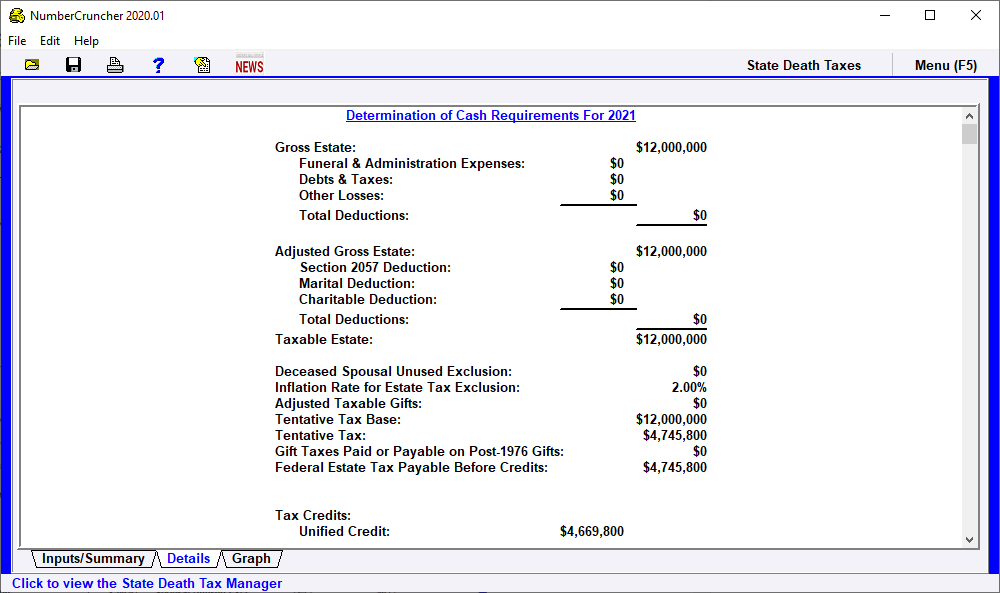

Cash Need Determination Of Cash Requirements Leimberg Leclair Lackner Inc

2020 New York Resident Estate Taxation Parisi Coan Saccocio Pllc

U S Estate Tax For Canadians Manulife Investment Management

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

The Estate Tax And Lifetime Gifting Charles Schwab

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

/UnifiedTaxCredit-d90e228472aa44e88eebc9866e3045d9.jpg)